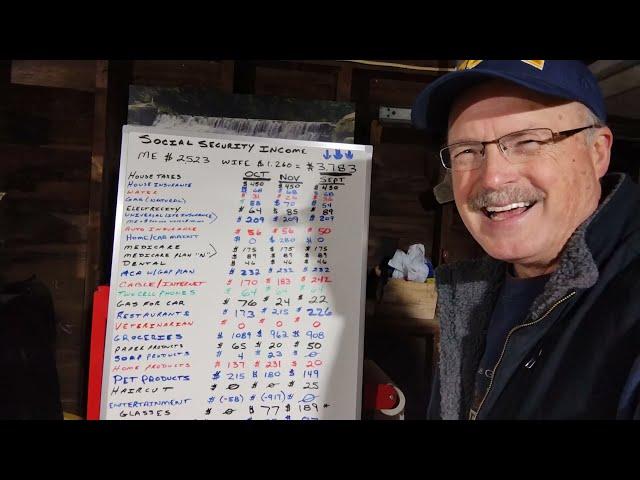

Trying to retire on our Social Security only. The one year experiment is over. See the results!

Комментарии:

Keep making vids, ill keep watching and liking.

Ответить

Thanks for sharing. This is great info for your own purposes that most people don’t know in their own situations. You have great knowledge of your expenses which is essential to living on SS . I’m hoping to be done with my PT job in 2025. Merry Christmas!

Ответить

It took me a while to understand what you were doing with this channel. At first, I thought you were a little crazy, trying to retire (in the US) on just Social Security income. I NOW realize that your channel is actually providing a very valuable service. You're showing, in black and white (and red and blue) how to create and follow a retirement budget. This is great stuff, really, because it shows all the different things we wind up spending money on and it illustrates how and why retiring on JUST Social Security isn't likely to work, long-term. Kudos for paying attention to the details and taking the time to share them with us. The big take-away is folks should learn how to budget so that they know where they really stand, financially. :)

Ответить

Thanks Buzz,

I live in Nova Scotia, Canada and I love watching how you do the budget.

Fortunately, for us our health care is payed through our taxes. So although people think it’s free ..it’s not. Our federal and provincial taxes pay for it.

I am going to miss your posts 🎄💕

Ditch the ink jet switch to a laser. They are cheap enough and the laser cartridges are a much better value

Ответить

Come on Buzz, enter December 2024 and start tracking by year.

Maybe you could add a line to report what you had to take out of savings each month.

Your updates are valuable to us!!! Many of your audience are approaching retirement and you are helping us with a realistic strategy.

Happy Birthday Buzz🎉

Ответить

I’m receiving SSDI and my husband will be retiring next year when he turns 62, but he’ll work part time as well. We have no mortgage and no consumer debt. I still don’t think JUST ss enough. It was never designed to be enough. Only a help.

Ответить

Check into smaller local auto ins. Cheaper than Geico and State Farm for the exact same coverage.

Ответить

For 2 people your groceries are at $1,000???? Holy smokes !!!

Cook from scratch, and eat 2 healthy meals a day. As we get older, we don’t need to eat 3 meals a day. My grand parents ate a big breakfast, no lunch and then a healthy evening meal around 5 pm. They both lived into their 90’s. Zero health issues. 😊

I’m 58, hubby is 61, and we too only eat 2 meals a day. We’ve done that now for 10 years 😊

I do believe medical bills cannot be charged interest. None of mine ever has. Are you in the USA ?

Ответить

I would do your spread sheet red (in the hole) black meaning in the positive 😊

I was a retail manager for 25 years.

I've been retired for about a year, I do use ss unless I have to dip into my 401 occaionally but mostly ss by itself.

Ответить

THANK YOU BUZZ! Wish I could have seen this 2 yrs ago - I retired July 2024 - a few years younger than you but there are lots of similarities & your videos have helped me see "budget". Keep it up!!

Ответить

Another good one Buzz! I Enjoy the content. Take care. Marc C out.

Ответить

Your a good man to think of your wife ❤

Ответить

Happy almost Birthday !

Ответить

Since 1971 the purchasing power of the dollar has lost 88%. This was caused by insane spending and

borrowing by the U S govt. Before 1971 we were on a gold standard and it help keep the spending/borrowing

in check somewhat. At this point in time there is no way to fix this mess. The govt must spend even more now

just to keep the economy going. They borrow from the fed with interest. Where does the fed get all that money to loan the govt.? They create it out of nothing. It is fake money. Called fiat money. It's an unsustainable house of cards, a Ponzi scheme that will collapse 100% guaranteed. So what will that do to

SS? It will be inflated away. Your SS payment will buy less and less until it's worthless. So those that plan on using SS for retirement will find themselves living in their car. And I suspect it will be sooner than later. IMO

What about taxes?

Ответить

HAPPY BIRTHDAY BUZZ

FROM OG SAN LUIS OBISPO, CA.

Thank you, Buzz for all of the videos. You inspired me to track my expenses beginning last January. It really makes me more thoughtful about my spending. Wishing you and your family a Merry Christmas and a wonderful New Year!

Ответить

Unfortunately, in order to live comfortably as a single person, one needs $5,000 USD a month.

Ответить

In order to retire on SS alone, unless you live in a cardboard box you'll need to work until you're eligible for the max benefit and by then you'll have one foot in the grave and the other on a banana peel. I cannot place enough emphasis on 401k paycheck deferral starting at a very young age cuz SS alone will not cut it if you wanna join the KMA (kiss my ass) Club before age 65 or even 62.

Ответить

Buzz: An interesting video would be you showing what the budget looks like without you. That would be helpful for others to understand. My wife's total expenses would drop 27%.

Ответить

I turn 65 on Jan 2 and I plan to retire Jan 3!! Happy Birthday......to BOTH of us!! :)

Ответить

This portion of your channel “The Monthly Budget” has been time consuming for You But intriguing for us! Hoping All’s Well! Looking forward to Bird FeederVideo,Walk Through of your finished Bathroom & Some Live Video of your Christmas lights on the House!! All The Best To You & Mrs Buzz! 🌲Merry Christmas 🌲 Be Well Be Safe & Stay Blessed.

Ответить

🤣🤣🤣

No one can afford to retire but we do. Everyone has bills to pay (and taxes).

Eliminate as many bills before you do retire.

Get funeral arrangements that you will use differently (and a will).

Enjoyed life.

I knew early on that retiring of SS was a suicidal run, so I made sure to factor in savings into my budget. I have lived on a budget my entire life, simply because I knew I had to, to survive, So went it came to retirement, it was like breathing for me, very natural. The key is discipline, which many people don't have. They feel as if it is restricting them, no, it is liberating them, if they would only give it a chance.

Ответить

Great stuff Buzz! You're doing great, only down $1k a year isnt bad at all!

Ответить

That’s a lot for property tax..you did good with your budget..

Ответить

I love the hat! Thanks for this series, very informative.

Ответить

Good job tracking all of this. It's a full time job just doing that. I'm still trying to figure out how you get by with so little gas for the car. Teach us your ways!

Ответить

It makes a Big difference if you retire at 62 or full retirement. I would never retire at,62. You handicap yourself right off the bat

Ответить

I will miss these budget videos! Thanks for doing them!!

Ответить

Thanks Buzz! I would caution to be very careful with the online gambling. It can easily get away from you as try and chase losses.

Ответить

Hopefully Elon Musk won’t screw things up for you

Ответить

Good job Buzz.

Ответить

I know the feeling with the non oem ink cartridges. Keep up the good work!

Ответить

So, this year we had to replace our roof and air conditioner that was 22,000 this year. Also, our fridge and dishwasher had to be replaced. Yikes! You might think about Costco for p/t job - I hear they pay pretty good and they seem to hire a lot of seniors.

Ответить

Wow Buzz that's not bad ... I think our first year was only a thousand, after 3 1/2 years 10k increase in debt. Leveraged against the house which has gone up in value 105k over the same period of time, so I feel pretty good about that. The HELOC payment has gone up $100 social security check $250 so feel good about that .. and we are doing that on less than 1/2 of your income. But when hard pressed you find away. In a facebook group where many are trying to make it on less than 1k a month..

Ответить

Excellent Breakdown Buzz. Thank you! And... Early Happy Birthday!

Ответить

Appreciate your videos and channel. If I give you $50 will you put the current month on the right side of the chart 😂. Kidding of course but I probably would consider $100 too

Ответить

Hi, Buzz. I watched this video when it first came out and a question has been on my mind ever since. Would you mind sharing what you spent $2,000 on for Christmas? That seems like a lot and I wonder what you splurged on.

Ответить

Another good one, Buzz! I’m hoping your channel grows and starts to help you build your retirement nest egg. you’re doing great so far, just on the retirement experiment.

Ответить

Retirement income needs to equal work income. With a COLA. That means SS & pension. If you don't have a pension you must sock away $500,000 to $1,000,000. Good luck with that.

Ответить

I would suggest work at a grocery store for a while Some of them do offer pension plans and healthcare I would also listen to Dave Ramsey And his baby steps seven baby steps

Ответить

Great detail! Those are your actuals - what are your targets for each of those expenses? I've been doing this, in this detail ,for 10 years, with targets. Many people track their expenses, but don't do anything to adjust the spending to match a target spend. Almost everyone thinks budgeting is keeping track of what they spend - but that is only the first part.

Ответить

![[라테일] 검호 찐막 카이로스 참, 젬 강화 끝 ...뚱냥이 이제 그만 봐도 됨 ㅎㅎ [라테일] 검호 찐막 카이로스 참, 젬 강화 끝 ...뚱냥이 이제 그만 봐도 됨 ㅎㅎ](https://rtube.cc/img/upload/NGx4NDhMNXVwa0w.jpg)

![[악보 찬양] 모든 걸음 되시네(주님 내 길 아시네) [악보 찬양] 모든 걸음 되시네(주님 내 길 아시네)](https://rtube.cc/img/upload/VTlTLW4xbVh6R0k.jpg)

![MY NEW MAIN! Asus ROG Keris II Ace Wireless Review [PH] MY NEW MAIN! Asus ROG Keris II Ace Wireless Review [PH]](https://rtube.cc/img/upload/QVAyenlSRlZFTHo.jpg)