Комментарии:

Please do market ratios , P/E ratio , dividend yield ratio ...etc

Ответить

i want that you should upload regularly which would help students like me who want to learn more , more than what school is teaching me

Ответить

Cool!!! But what about ROIC ?

Ответить

James can you please do a video about PARTNERSHIP ACCOUNTS, by the way this video was great,THANK YOU

Ответить

Thanks a lot for this video ✅ , much appreciated 👍

Ответить

Hello James! Loved your full length compilation on accounting which helped me with my investment journey.

Request you to make a series on how to detect accounting fraud by listed companies through analysis of the holy Trinity : income statement, cash flow and balance sheet.

Just want to say your video was in my recommended page. And I’m not even trying to be an accountant. But the way you explain the topics in your videos is so simple and easy to grasp the concept, I watch your videos to learn something new! Great content keep up the good work!!

Ответить

Hi James Chudley! I just want you to know that you've made a massive impact on my life. My kids and I sit and watch your videos together at dinner time. Great for family movie nights! Love you Pookie bear. I named my child chudley because your video on how to do a bank reconciliation (EASY WAY) was so inspiring. I would sit and cry at how everything finally made sense. I love you man, take care! Love the dog too. Bye James <3

Ответить

Please make a video about contracts

Ответить

Can you make a video on Special Journals

Ответить

can you please do a video on multi step, classified multi step and single step income statement formats?

Ответить

Can you please make a series on consignment accounting...... It would really help, I love your videos but it's sad that I so desperately want to learn consignment but your channel doesn't have them

Ответить

Might be a bit of a stretch to ask, but consolidated financial accounting overview would be a great video😂 there's a lot of journal entries relating to the at- and since- aquisition of a subsidiary and elimination of all intragroup transactions. It gets quite confusing having to remember the structure of everything. Thanks for your videos! They help a lot with recap before examinations.

Ответить

I enjoyed this video

Ответить

Video on bad debts and allowance for receivables plsss

Ответить

This video helped me Significantly on the night before my Finance exam, I am very much grateful to your channel. Your videos also helped me to clear my doubts on Ledger and Equity from Accounting principles course. Thank you very very much for your Great content. (I am a Management major Under-grad student, btw)

Ответить

is there someone who doesn't have fucking marbles in their mouth talking about this

Ответить

Thanks for all your content, I have a question on ROCE, you said capital employed is long-term debt, but you used current liabilities amount in the example shouldn't it be non-current?

Ответить

❤❤❤❤❤❤❤❤

Ответить

WOW!!!

I’m so glad I found your channel.

Hello. Can you make Financial ratios for a Supermarket Business?

Ответить

Humko poochhne ka hak hai ke Allah ka Diya hua sofe mein Allah ki Rashi kya hai ya nahin aur yah halal hai ya haram hai puchenge kyunki hamara Imaan Allah uske rasulpur hai Sare khajane allah ke pass hai jameen Aasman female Aasman ke vah fakir ko Badshah banaa Badshah ko fakir bhi banaa sakta hai yah uski Shan hai mohalla ke raste per hi chalte Hain yad rakho Allah ki yad mein jilon Ko sukun milta hai La ilaha illallah muhammadur rasulullah

Ответить

Why Edison? He undermined Tesla.

Ответить

❤

Ответить

Another informative video, thanks! So it looks like Edison Motors is actually a real company, it's located in BC and it will manufacture off-highway hybrid semi trucks. Great minds think alike eh? :)

Ответить

than you for very informative videos!. quick question. in ROCE calculation for Capital Employment. You telling that it is owners equity + long term debt. Why then you calculate it as : total assets - current liabilities? cause we have numbers for total Equity and total long term debt? just trying to understand :). thank you

Ответить

Keep them accounting videos coming James, thanks 🙏🏾

Ответить

👍👍👍👍👍👍👍

Ответить

Excellent explanation

Ответить

You should turn it into a course on Udemy.

Excellent stuff.

Thanks for the info.

Pls give examples of typical benchmarks for such ratios per industry.

Ответить

If you could go through how the ratios relate to each other that would be great!

Ответить

How to I calculate those profitability ratios for the first year and second year?

Ответить

Bro thank you for doing the Lord's work bro

Ответить

James as a Corporate Attorney you have shown a better way to explain to all my juniors how to do accounting. Here are some areas that I deal with that I would love to here you touch on.

Profitability Ratios

1. Gross Profit Margin (GPM) = (Gross Profit / Revenue) x 100

2. Operating Profit Margin = (Operating Income / Revenue) x 100

3. Net Profit Margin = (Net Income / Revenue) x 100

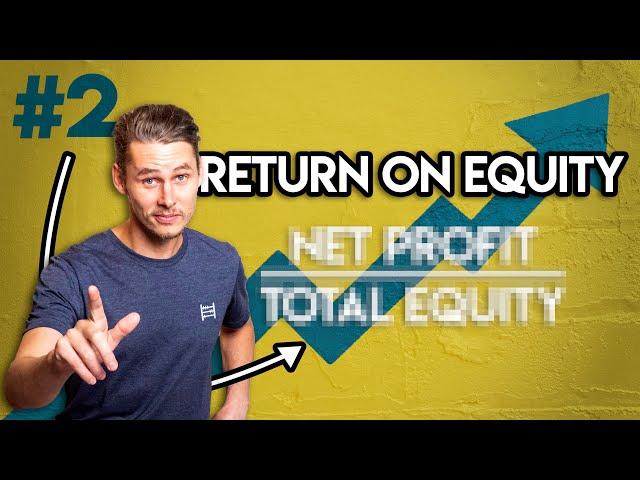

4. Return on Assets (ROA) = (Net Income / Total Assets) x 100

5. Return on Equity (ROE) = (Net Income / Shareholders' Equity) x 100

6. Return on Investment (ROI) = (Net Profit / Investment Cost) x 100

7. Return on Sales (ROS) = (Operating Income / Revenue) x 100

8. Earnings Before Interest and Taxes (EBIT) Margin = (EBIT / Revenue) x 100

9. Return on Capital Employed (ROCE) = (EBIT / Capital Employed) x 100

Liquidity Ratios

1. Current Ratio = Current Assets / Current Liabilities

2. Quick Ratio (Acid-Test) = (Current Assets - Inventory) / Current Liabilities

3. Cash Ratio = Cash and Cash Equivalents / Current Liabilities

4. Operating Cash Flow Ratio = Operating Cash Flow / Current Liabilities

Efficiency Ratios (Activity Ratios)

1. Inventory Turnover = Cost of Goods Sold / Average Inventory

2. Days Sales in Inventory (DSI) = 365 / Inventory Turnover

3. Accounts Receivable Turnover = Revenue / Average Accounts Receivable

4. Days Sales Outstanding (DSO) = 365 / Accounts Receivable Turnover

5. Accounts Payable Turnover = Cost of Goods Sold / Average Accounts Payable

6. Days Payable Outstanding (DPO) = 365 / Accounts Payable Turnover

7. Asset Turnover Ratio = Revenue / Average Total Assets

8. Working Capital Turnover = Revenue / Working Capital

Leverage Ratios (Solvency Ratios)

1. Debt-to-Equity Ratio = Total Debt / Shareholders' Equity

2. Debt Ratio = Total Debt / Total Assets

3. Equity Ratio = Shareholders' Equity / Total Assets

4. Interest Coverage Ratio = EBIT / Interest Expense

5. Debt Service Coverage Ratio (DSCR) = Operating Income / Total Debt Service

6. Financial Leverage Ratio = Average Total Assets / Average Shareholders' Equity

Market Ratios (Investor Ratios)

1. Earnings Per Share (EPS) = Net Income / Average Outstanding Shares

2. Price to Earnings Ratio (P/E Ratio) = Market Price per Share / Earnings per Share

3. Dividend Yield = Annual Dividends per Share / Market Price per Share

4. Dividend Payout Ratio = Dividends / Net Income

5. Book Value per Share = Shareholders' Equity / Total Outstanding Shares

6. Price to Book Ratio (P/B Ratio) = Market Price per Share / Book Value per Share

Growth Ratios

1. Sales Growth Rate = ((Current Period Sales - Previous Period Sales) / Previous Period Sales) x 100

2. Net Income Growth Rate = ((Current Period Net Income - Previous Period Net Income) / Previous Period Net Income) x 100

3. Dividend Growth Rate = ((Current Period Dividend - Previous Period Dividend) / Previous Period Dividend) x 100

Thank you for making this click in my head...finally!!!

Ответить

This might be more of a marketing thing but can you make a video explaining yield percentage.

Ответить

Your channel is such a blessing. I am trying to study for my exam and this videos ARE super helpful and insightful.

Ответить

I think I finally get it. I'm so happy I saved this channel❤

Ответить

Thank you so much!. I watched few of your videos today . this is my first comment for you. this is the best content, clear, quality and very creative presentation what I watched ever. I will watch another vdos also from today onwards. Please keep it up!

Ответить

Long term solvency ratios plss. ❤❤❤

Ответить

Very nicely explained!

Ответить

Hey man. Would love PE, alpha, beta, roce, and other technical indicators.

Love the overall video irrespective

You’re the best 🔥❤️🥳👏🏻

Ответить

How did you get the net profit value

Ответить