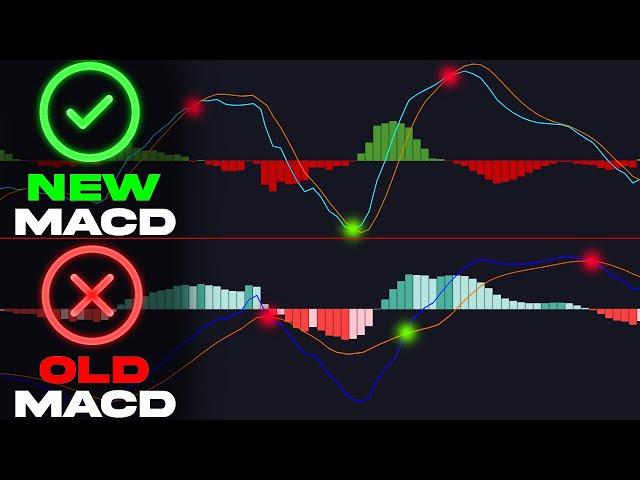

Best 3 Indicators That Are 10x Better Than MACD

Комментарии:

Best 3 Indicators That Are 10x Better Than MACD

Switch Stats

E. Grieg — Piano Concerto in A Minor, Op.16

Ilya Shmukler

Transit On the Water: Top 10 Ferry and Water Taxi Cities in North America

Ray Delahanty | CityNerd