PART 4 _ Power of 50 Moving Average @thecybersecurityclassroom

### Introduction to Moving Averages

Moving averages are one of the most widely used tools in technical analysis. They help traders smooth out price data to identify trends over a specific period. The 50 MA is particularly valuable as it represents an intermediate-term trend indicator, balancing between short-term fluctuations and long-term trends.

### Understanding the 50 Moving Average

The 50 Moving Average calculates the average of the last 50 price points, updating with each new data point. This average helps traders filter out noise and focus on the overall direction of the market.

### Significance of the 50 Moving Average

1. **Trend Identification**: The 50 MA is a powerful tool for identifying the prevailing market trend. When the price is above the 50 MA, it indicates an uptrend, while a price below the 50 MA suggests a downtrend.

2. **Support and Resistance Levels**: The 50 MA often acts as a dynamic support or resistance level. Traders can use it to make informed decisions about entry and exit points.

3. **Crossovers**: Crossovers between the 50 MA and other moving averages, such as the 200 MA, are critical signals for potential trend reversals. The Golden Cross (50 MA crossing above the 200 MA) and the Death Cross (50 MA crossing below the 200 MA) are particularly noteworthy.

### Applications in Trading Strategies

1. **Trend Following**: Traders use the 50 MA to follow trends, entering trades in the direction of the trend and exiting when the trend shows signs of reversing.

2. **Mean Reversion**: Some traders use the 50 MA to identify overbought or oversold conditions. When the price deviates significantly from the 50 MA, it may revert back to the mean, providing trading opportunities.

3. **Momentum Trading**: The 50 MA can help traders gauge the momentum of a trend. Strong trends often show consistent support or resistance around the 50 MA, indicating sustained momentum.

4. **Swing Trading**: Swing traders use the 50 MA to identify potential reversal points. By analyzing price action around the 50 MA, they can anticipate swings and capitalize on short-term price movements.

### Integrating the 50 Moving Average with Other Indicators

1. **Relative Strength Index (RSI)**: Combining the 50 MA with RSI can enhance trading signals. For example, a bullish crossover above the 50 MA with an RSI above 50 strengthens the buy signal.

2. **Bollinger Bands**: The 50 MA can serve as the middle line of Bollinger Bands, helping traders identify overbought and oversold conditions and potential breakouts.

3. **MACD**: The Moving Average Convergence Divergence (MACD) indicator works well with the 50 MA. Crossovers between the MACD and the signal line, when aligned with the 50 MA trend, provide robust trading signals.

### Advanced Trading Techniques with the 50 Moving Average

1. **Multiple Time Frame Analysis**: Traders can use the 50 MA across different time frames to confirm trends. For instance, aligning the 50 MA trend on daily, weekly, and monthly charts strengthens the trend’s validity.

2. **Backtesting and Optimization**: Backtesting strategies involving the 50 MA on historical data helps traders understand its effectiveness and optimize parameters for different market conditions.

3. **Algorithmic Trading**: The 50 MA is a popular component in algorithmic trading systems. Its simplicity and effectiveness make it suitable for automated trading strategies.

### Risk Management

Effective use of the 50 MA requires robust risk management practices. Traders should use stop-loss orders, position sizing, and risk-reward ratios to protect their capital while leveraging the 50 MA's signals.

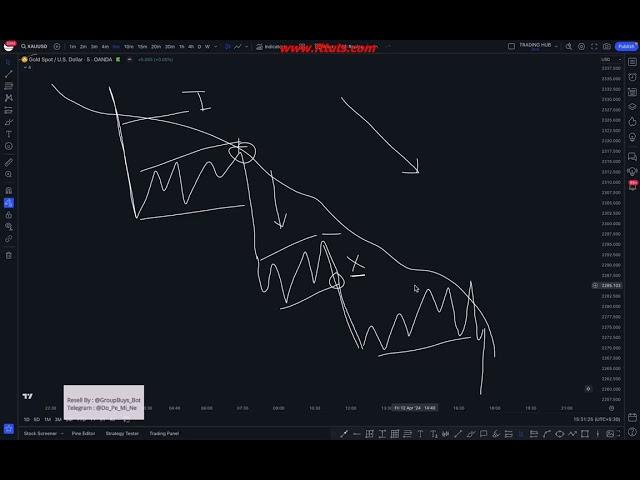

### Case Studies and Examples

1. **Stock Market**: Analyzing historical price movements of major stocks with the 50 MA to illustrate its effectiveness in various market conditions.

2. **Forex Trading**: Demonstrating the application of the 50 MA in currency trading, highlighting successful trades and common pitfalls.

3. **Cryptocurrency**: Exploring how the 50 MA performs in the highly volatile cryptocurrency market.

# Key Takeaways

1. **Intermediate-Term Trend Indicator**: The 50 MA balances short-term noise and long-term trends, making it a reliable trend indicator.

2. **Dynamic Support and Resistance**: The 50 MA frequently acts as a support or resistance level, aiding in strategic trade placement.

3. **Versatility**: Its applications span various trading strategies, from trend following to algorithmic trading.

4. **Integration**: Combining the 50 MA with other technical indicators enhances its effectiveness.

5. **Risk Management**: Proper risk management is crucial when trading with the 50 MA to protect against potential losses.

#Optimization #RSI #BollingerBands #MACD #SupportAndResistance #PriceAction #FinancialMarkets #Investment #GoldenCross #DeathCross #DynamicSupport #ResistanceLevels #MarketTrends #TradingIndicators #AutomatedTrading

Moving averages are one of the most widely used tools in technical analysis. They help traders smooth out price data to identify trends over a specific period. The 50 MA is particularly valuable as it represents an intermediate-term trend indicator, balancing between short-term fluctuations and long-term trends.

### Understanding the 50 Moving Average

The 50 Moving Average calculates the average of the last 50 price points, updating with each new data point. This average helps traders filter out noise and focus on the overall direction of the market.

### Significance of the 50 Moving Average

1. **Trend Identification**: The 50 MA is a powerful tool for identifying the prevailing market trend. When the price is above the 50 MA, it indicates an uptrend, while a price below the 50 MA suggests a downtrend.

2. **Support and Resistance Levels**: The 50 MA often acts as a dynamic support or resistance level. Traders can use it to make informed decisions about entry and exit points.

3. **Crossovers**: Crossovers between the 50 MA and other moving averages, such as the 200 MA, are critical signals for potential trend reversals. The Golden Cross (50 MA crossing above the 200 MA) and the Death Cross (50 MA crossing below the 200 MA) are particularly noteworthy.

### Applications in Trading Strategies

1. **Trend Following**: Traders use the 50 MA to follow trends, entering trades in the direction of the trend and exiting when the trend shows signs of reversing.

2. **Mean Reversion**: Some traders use the 50 MA to identify overbought or oversold conditions. When the price deviates significantly from the 50 MA, it may revert back to the mean, providing trading opportunities.

3. **Momentum Trading**: The 50 MA can help traders gauge the momentum of a trend. Strong trends often show consistent support or resistance around the 50 MA, indicating sustained momentum.

4. **Swing Trading**: Swing traders use the 50 MA to identify potential reversal points. By analyzing price action around the 50 MA, they can anticipate swings and capitalize on short-term price movements.

### Integrating the 50 Moving Average with Other Indicators

1. **Relative Strength Index (RSI)**: Combining the 50 MA with RSI can enhance trading signals. For example, a bullish crossover above the 50 MA with an RSI above 50 strengthens the buy signal.

2. **Bollinger Bands**: The 50 MA can serve as the middle line of Bollinger Bands, helping traders identify overbought and oversold conditions and potential breakouts.

3. **MACD**: The Moving Average Convergence Divergence (MACD) indicator works well with the 50 MA. Crossovers between the MACD and the signal line, when aligned with the 50 MA trend, provide robust trading signals.

### Advanced Trading Techniques with the 50 Moving Average

1. **Multiple Time Frame Analysis**: Traders can use the 50 MA across different time frames to confirm trends. For instance, aligning the 50 MA trend on daily, weekly, and monthly charts strengthens the trend’s validity.

2. **Backtesting and Optimization**: Backtesting strategies involving the 50 MA on historical data helps traders understand its effectiveness and optimize parameters for different market conditions.

3. **Algorithmic Trading**: The 50 MA is a popular component in algorithmic trading systems. Its simplicity and effectiveness make it suitable for automated trading strategies.

### Risk Management

Effective use of the 50 MA requires robust risk management practices. Traders should use stop-loss orders, position sizing, and risk-reward ratios to protect their capital while leveraging the 50 MA's signals.

### Case Studies and Examples

1. **Stock Market**: Analyzing historical price movements of major stocks with the 50 MA to illustrate its effectiveness in various market conditions.

2. **Forex Trading**: Demonstrating the application of the 50 MA in currency trading, highlighting successful trades and common pitfalls.

3. **Cryptocurrency**: Exploring how the 50 MA performs in the highly volatile cryptocurrency market.

# Key Takeaways

1. **Intermediate-Term Trend Indicator**: The 50 MA balances short-term noise and long-term trends, making it a reliable trend indicator.

2. **Dynamic Support and Resistance**: The 50 MA frequently acts as a support or resistance level, aiding in strategic trade placement.

3. **Versatility**: Its applications span various trading strategies, from trend following to algorithmic trading.

4. **Integration**: Combining the 50 MA with other technical indicators enhances its effectiveness.

5. **Risk Management**: Proper risk management is crucial when trading with the 50 MA to protect against potential losses.

#Optimization #RSI #BollingerBands #MACD #SupportAndResistance #PriceAction #FinancialMarkets #Investment #GoldenCross #DeathCross #DynamicSupport #ResistanceLevels #MarketTrends #TradingIndicators #AutomatedTrading

Комментарии:

PART 4 _ Power of 50 Moving Average @thecybersecurityclassroom

The Cybersecurity Classroom

How I Packed ONLY a Personal Item to Fly Frontier

Laura Bronner

Landing A New Job After A COVID Layoff

Lynee Alves

Юнгфрау марафон 2019 (Jungfrau marathon)

Beresnev-Runner

2025 Custom Happy Planner Unboxing and Setup! Shop and Assemble With Me!

Planning with Bumble

Mondi Consumer Insights for Premium Pet Food Packaging

Mondi North America

La teoria dei Loacker

Roberto Mercadini