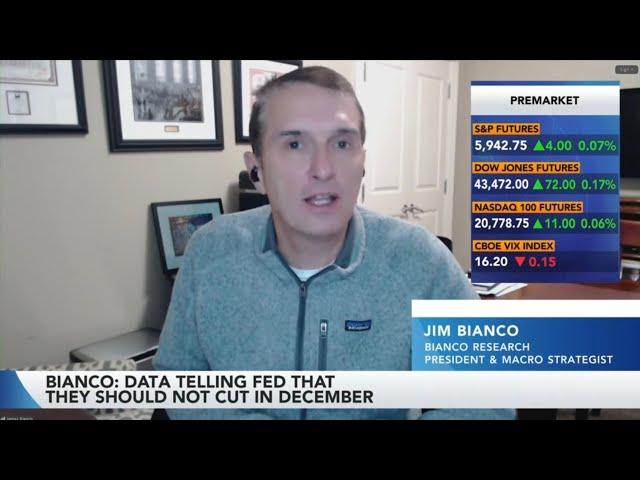

Jim Bianco: "We don't need the Fed to be cutting interest rates in this environment"

Комментарии:

This guy is backward.

Ответить

10 yr bond is anticipating inflation.

Ответить

JB is sincere & quality Dude!

Ответить

Now 3,4% inflation world. Make sense to the rest of them as soon as we didn't get that recession at the beginning of 2023, I started seeing that the fed chose inflation over recession

Ответить

LOL.... Jim, the Fed is cutting because US Gov is insolvent, it's not about inflation, come on, you are too smart to NOT see this.

Ответить

Sound like Jim actually believes the Gov stats lol

Ответить

Econ is doing fine = F-d, Insecure, Neurotic and Excitable. Yup it is fine, fine, fine...

Ответить

What a useless idiot.

Ответить

@Bianco Research - could you please publish these posts in podcast format like you used to? They were great to listen to on the go

Ответить

Jim Bianco has been right all along! He has made the most sense to me.

Ответить

"The economy is doing fine"???? Did you read Targets' miss today?

Ответить

Don't simply retire from something; have something to retire to. Start saving, keep saving, and stick to investments

Ответить

Detective of money politics is following this very informative content cheers from VK3GFS and 73s from Frank Melbourne Australia

Ответить

half point cut was a political gift to the treasury and the dems they thought.

Ответить

10yr below 4.5 is a terrible deal

Ответить

Bloomberg boulshevick didn’t care when Demoncats were borrowing and spending trillions on the fraudulent infrastructure act. That is where this inflation came from. This network hates president TRUMP and it shows every day

Ответить

Everyone forgets how 2 years ago Powell was pretending to be volcker. What a joke. Gold, inflation swaps, bond risk premium are all telling you not to do it. But they will do it based on this idiotic “real rates” construct based on some abstract neutral rate they have no idea about.

Ответить

With the Fed cutting interest rates by 50 bps, what do you think will happen to the stock market? My portfolio has performed exceptionally well this year, but I am concerned about the possibility of a market crash and losing my gains though but, it's all on a brighter and splurging side for Gold, should I look that way?

Ответить

I can't believe the FED cut even once this is ridiculous

Ответить

Pro Growth wins👍👍

Ответить

I see the rising interest rate as a very big problem, as more investors will definitely pull out more money from the Stock market. This might have worked when I was still invest-ing with a couple thousand dollars, but it is more difficult now to decide whether to pull out more than $365k from my port-folio. I know some inves-tors still make that despite the strong bear market. In wish I could pull that feat

Ответить