Warren Buffett: Should You Invest in a Stock With a High P/E Ratio?

Комментарии:

So he said, "No"

Ответить

I look for prospective pending acquisitions and/or talk of foreign partnerships/expansion for a fair share price or ipo

Ответить

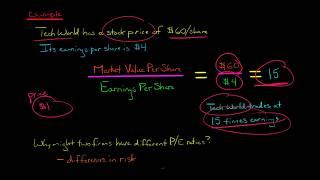

PE ratio goes up with price increase, but even more with Earnings decrease. I prefer to watch price and earnings separately.

Ответить

The collapse of Margin debt leads to a decrease in stock prices and trigger a wave of selling as investors try to cover their losses, Buying a stock is easy, but buying the right stock without a time-tested strategy is incredibly hard. Hence what are the best stocks to buy now or put on a watchlist? I’ve been trying to grow my portfolio of $145K for sometime now, my major challenge is not knowing the best entry and exit strategies ... I would greatly appreciate any suggestions

Ответить

Is i invest in 50 pe ratio

Ответить

RUSSIA🇷🇺 MKT CAP TO GDP -23% UNDERVALUED BUFFETT INDICATOR /200% USA 🇺🇸INDIA🇮🇳 POPULAR

Ответить

RUSSIAN🇷🇺COMPANIES PE RaTIO BELOW 5 /2- RTS 140000 MEANING COMPANIES EARN 50 LAKH INR EVERY YEAR ON 1 CR MKT CAP 🧢🎩- UNDERVALUED INVESTOR IS REALIST WHO BUY FROM PESSIMIST SELL TO OPTIMIST BUY STOCKS CRYPTO FOR LONG TERM CONNECTIVITY NOT GROWTH - BUY PUT CALL STOCKS CRYPTO FUTURES FOR SHORT TERM UNCERTAINTY (2) USA -30/ INDIA🇮🇳-30 OVERVALUED

Ответить

@Investor center: Why do investors think PE is important when it has got zero correlation with your outcome. For example, American Express trades a multiple of 15 with trailing 5year return of 48%. Whereas Mastercard, trades at a multiple of 37 with trailing 5year return of 126%. At the end of the day, my 100 dollars in American Express becomes 148 and the same becomes 226 with Mastercard. So who cares if I overpaid or got less ownership of the company. Correct me if I am wrong. What am I missing here?

Ответить

10.000 ?

Ответить

BUFFED AND CHARLIE BOUGHT AMAZON AT P/E 78 LOL

Ответить

Well the challenge is to buy low p/e that become high p/e in short to medium term.

Ответить

The challenge with the simple dive is you don't dive in shallow waters and hit your head on the floor.

Ответить

charlie counting train cars

Ответить

Don''t i wanna invest in stocks with low Price to earning ratio? The more money is earned on every dollar invested the better i.e. low p/e... no?

Ответить

Remember, guys: a good company is not always a good investment, it depends on the price you pay for it.

Ответить

Confirmed: Charlie sips his coke about once a minute.

Ответить

I like it! You get paid just as well the simple dive as long as you execute it well! Don't make it so complicated, keep it simple and go for the high probability of return

Ответить

P/E is relative and just another metric to compare and get a quick idea. But if it's because of real growth, it's acceptable while it's not very high. If it's just hype, then you are taking too much risk.

Ответить

Classic Charlie 😁

Ответить

Sorry I’m not sure I get the message right, does this imply why searching for a high P/E stock when a low PE ratio stock has same earnings prospects as high PE stocks?

Ответить

Warren the goat. This is really good to know as Tesla's P/E so high.

Ответить

I loved the fact how Charlie's interestingly very uninterested in what buffet has to say 😂😂

Ответить

well said from the one and only

Ответить

Thank you for this excellent video👍

Ответить

Buffett the legend ❤️

Ответить