Bionic Turtle

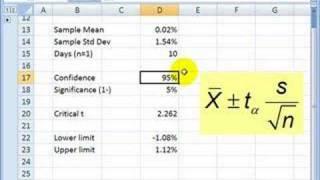

Bionic Turtle Coupon Codes & Promo Codes 2020: Claim $50 Discount

Affiliate Bay

320

1,065

4 года назад

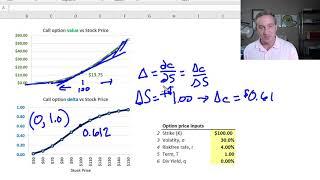

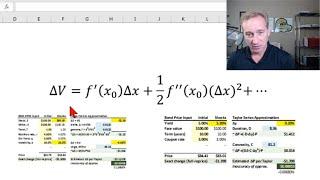

Delta-gamma value at risk (VaR) with the Taylor Series Approximation (FRM T4-4)

Bionic Turtle

5K

17,829

6 лет назад

David Harper Discussing Working with Jeff Bezos, Selling Bionic Turtle, Mark Meldrum's Business

Straight Talks - AJ Srmek

309

1,030

2 года назад

Сейчас ищут

Bionic Turtle

Nondualism

Фармбонус

Sergio Degollado

Hitman 3 Agent 47 Gives Advice

W Dwayne

Dangerouscliffs

Недвижимость В Оба Алания

Страшный Квест

Crazy Glass Lady

Куртамыш

Bambina

Milkyway Art Design By Sharmin Khan

Ukraine Wedding

Vidcast

Bambina Montate Official Music Video

Celinaspookyboo

20Breakbeat20

Visage First Chapter

Motos Fly Pasión

Пентхаус В Турции

Відеограф

5Ge

Paputzaa Diy

Зевс Против Хейдеса

Фонд Бизнес Ангелов

Colombianos

Bobby Jean Dreamin Ft Tokyo Vanity

Internetv Deportes

Metajungle

Twowings

Bricktop

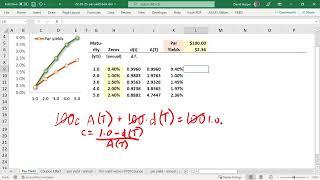

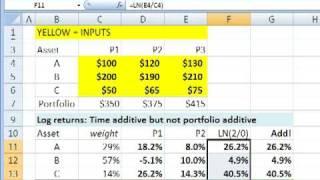

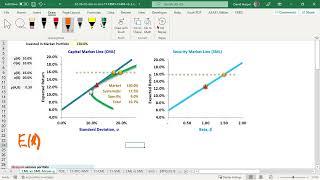

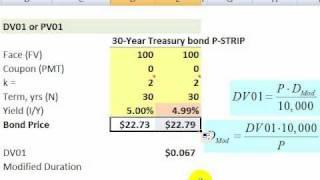

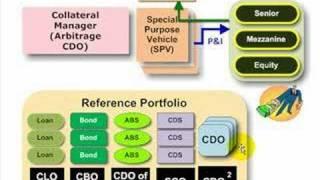

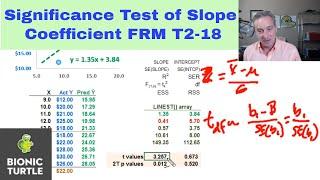

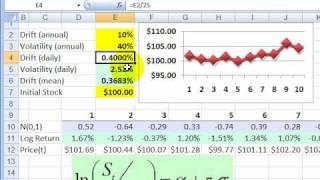

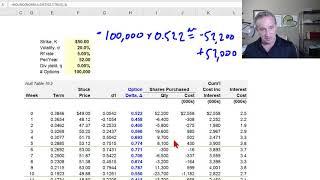

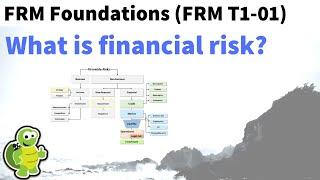

Bionic Turtle. Смотреть видео: Bionic Turtle Coupon Codes Promo Codes 2020 Claim 50 Discount, Hedging Aka Neutralizing Option Delta And Gamma FRM T4 19, Why Par Yields Are The Best Interest Rate Measure, FRM Why We Use Log Returns In Finance.