The Digital Dollar, Explained

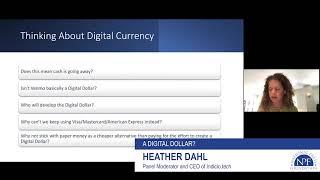

Move Over, Bitcoin: U.S. and Others Are Designing Central Bank Digital Currencies. MIT and the U.S. Federal Reserve Board are expected to announce more details about a digital dollar this fall. Digital currencies may be faster, cheaper and safer. But a digital dollar will also need to protect privacy.

by Sonni Efron, National Press Foundation

Digital currencies come in three basic flavors. Bitcoin and Dogecoin are examples of “decentralized cryptocurrency,” or digital money that is not backed up by another asset. They have value because they are scarce and people want them, explained Josh Lipsky of the Atlantic Council. Cryptocurrencies use encryption and usually blockchain to ensure security. “Stablecoins” are cryptocurrencies that are pegged to and backed up by a reserve asset. This could be the dollar, or a basket of currencies, or a commodity like gold. One example is Facebook’s Diem, which is to be launched this year. Because stablecoins are backed by an asset, they are less volatile. “Central Bank Digital Currency” is a digital representation of a country’s national or “fiat” currency. The Chinese digital yuan has a picture of the paper yuan bill and is kept in a digital wallet app on consumers’ cellphones. Like the dollar, a CBDC is issued by the central bank, not a private bank.

Why do we need a digital dollar? Cash is expensive to make and handle, electronic transfers can be slow, and cryptocurrencies are unregulated. CBDCs offer governments more policy options -- and control. “Central banks [are] getting into the game, saying, wait a second, we've got Bitcoin out here. We've got Facebook out here. We can't let all this money supply come into these economies without our traditional money supply having a voice in this,” Lipsky said. That’s why 75 countries were introducing, piloting or researching CBDCs as of April 20. Journalists can follow the status of these projects on the Atlantic Council’s CBDC Tracker.

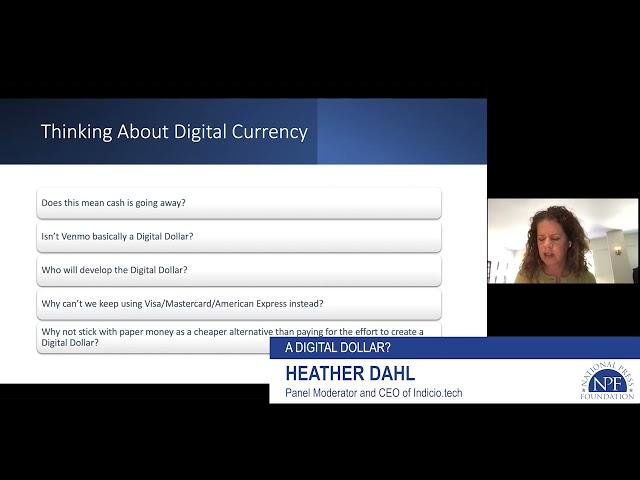

The U.S. faces many choices about how the digital dollar would work. The Federal Reserve Board (the U.S. central bank) has commissioned the MIT Media Lab to research how best to design the digital currency. Much of that project is private, but public information about the research efforts can be found here. More information is expected to be released this fall. Eventually, the Fed could decide to offer Americans free CBDC accounts, or it could allow private banks to offer them, or both. Digital dollars could be a boon for low-income people who cannot afford the fees charged by commercial banks (they are referred to as “unbanked”), and send stimulus or other payments that way, while commercial banks might offer their customers digital dollar accounts just as they now offer bank accounts, Visa and Mastercards, ACH transfers, wire transfers, or instant money-sending apps like Zelle. The blueprint for the financial infrastructure on which digital money will move, which experts refers to as the “rails,” hasn’t been drawn up yet. “Who will build that infrastructure, who will do the coding of a digital dollar? That may very well be a partnership between the Fed and the private sector,” says Adrienne Harris of the University of Michigan, a former Special Assistant to President Obama for financial services. “It may just be that the Fed endeavors to do that on its own. We don't really know. In different countries, it's taken different forms.”

Privacy guarantees will be essential to a successful digital dollar, experts agreed. China says its central bank cannot see transactions made from digital wallets. Citizens have told researchers they don’t believe that, but about 500,000 are using the digital yuan nonetheless, Lipsky said. The digital currency gives the Chinse government immense powers. “What if China says we have our digital yuan, but because Nike boycotted what's happening in Xinjiang, no one can use digital yuan at a Nike store?” Lipsky said. But Daniel Gorfine, a co-founder of the Digital Dollar Project, said commercial payment platforms such as WeChat already have more than a billion users, with no privacy protections for consumers – a problem CBDCs could solve.

Americans could still keep their cash. While the pandemic has accelerated a global drop in the use of cash, the advent of digital currencies such as Bitcoin, services like Venmo, or central bank digital currencies does not mean cash will go away. Gorfine explained how cash can still coexist alongside credit cards, commercial bank money and CBDCs that are backed by the full faith and credit of the government – if the financial system is designed properly. But you probably won’t have to stand in line at an international airport to change your money into piles of foreign bills – there will be an app for that.

This program was funded by the Hinrich Foundation. NPF is solely responsible for the content.

NPF website: https://nationalpress.org/

NPF resources on Trade: https://nationalpress.org/topics/trade/

by Sonni Efron, National Press Foundation

Digital currencies come in three basic flavors. Bitcoin and Dogecoin are examples of “decentralized cryptocurrency,” or digital money that is not backed up by another asset. They have value because they are scarce and people want them, explained Josh Lipsky of the Atlantic Council. Cryptocurrencies use encryption and usually blockchain to ensure security. “Stablecoins” are cryptocurrencies that are pegged to and backed up by a reserve asset. This could be the dollar, or a basket of currencies, or a commodity like gold. One example is Facebook’s Diem, which is to be launched this year. Because stablecoins are backed by an asset, they are less volatile. “Central Bank Digital Currency” is a digital representation of a country’s national or “fiat” currency. The Chinese digital yuan has a picture of the paper yuan bill and is kept in a digital wallet app on consumers’ cellphones. Like the dollar, a CBDC is issued by the central bank, not a private bank.

Why do we need a digital dollar? Cash is expensive to make and handle, electronic transfers can be slow, and cryptocurrencies are unregulated. CBDCs offer governments more policy options -- and control. “Central banks [are] getting into the game, saying, wait a second, we've got Bitcoin out here. We've got Facebook out here. We can't let all this money supply come into these economies without our traditional money supply having a voice in this,” Lipsky said. That’s why 75 countries were introducing, piloting or researching CBDCs as of April 20. Journalists can follow the status of these projects on the Atlantic Council’s CBDC Tracker.

The U.S. faces many choices about how the digital dollar would work. The Federal Reserve Board (the U.S. central bank) has commissioned the MIT Media Lab to research how best to design the digital currency. Much of that project is private, but public information about the research efforts can be found here. More information is expected to be released this fall. Eventually, the Fed could decide to offer Americans free CBDC accounts, or it could allow private banks to offer them, or both. Digital dollars could be a boon for low-income people who cannot afford the fees charged by commercial banks (they are referred to as “unbanked”), and send stimulus or other payments that way, while commercial banks might offer their customers digital dollar accounts just as they now offer bank accounts, Visa and Mastercards, ACH transfers, wire transfers, or instant money-sending apps like Zelle. The blueprint for the financial infrastructure on which digital money will move, which experts refers to as the “rails,” hasn’t been drawn up yet. “Who will build that infrastructure, who will do the coding of a digital dollar? That may very well be a partnership between the Fed and the private sector,” says Adrienne Harris of the University of Michigan, a former Special Assistant to President Obama for financial services. “It may just be that the Fed endeavors to do that on its own. We don't really know. In different countries, it's taken different forms.”

Privacy guarantees will be essential to a successful digital dollar, experts agreed. China says its central bank cannot see transactions made from digital wallets. Citizens have told researchers they don’t believe that, but about 500,000 are using the digital yuan nonetheless, Lipsky said. The digital currency gives the Chinse government immense powers. “What if China says we have our digital yuan, but because Nike boycotted what's happening in Xinjiang, no one can use digital yuan at a Nike store?” Lipsky said. But Daniel Gorfine, a co-founder of the Digital Dollar Project, said commercial payment platforms such as WeChat already have more than a billion users, with no privacy protections for consumers – a problem CBDCs could solve.

Americans could still keep their cash. While the pandemic has accelerated a global drop in the use of cash, the advent of digital currencies such as Bitcoin, services like Venmo, or central bank digital currencies does not mean cash will go away. Gorfine explained how cash can still coexist alongside credit cards, commercial bank money and CBDCs that are backed by the full faith and credit of the government – if the financial system is designed properly. But you probably won’t have to stand in line at an international airport to change your money into piles of foreign bills – there will be an app for that.

This program was funded by the Hinrich Foundation. NPF is solely responsible for the content.

NPF website: https://nationalpress.org/

NPF resources on Trade: https://nationalpress.org/topics/trade/

Комментарии:

The Digital Dollar, Explained

National Press Foundation

Did PETER FINCH & I Just Smash This New COURSE RECORD?

Matt Fryer Golf

Yarden Beach Apartment - Studio apartment

Roy Ben Shmuel

ALTENBURG ARTS - A recap of our inaugural season 2019/20!

Altenburg Arts

3 Exercises for weight loss || BoxFit

BoxFit India

10 Signs You're More Than Friends

True Medallion

07.06.2024 kell 19:00 / Dance Box Studio отчетный концерт!

MTU ESN - Edukad Sillamae Noored

Отзыв об установке окон от Ломтатидзе Орлета Николаевна

Форточка - Пластиковые окна в Ростове-на-Дону