Bionicturtle

Bionic Turtle Coupon Codes & Promo Codes 2020: Claim $50 Discount

Affiliate Bay

320

1,065

4 года назад

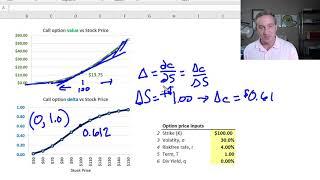

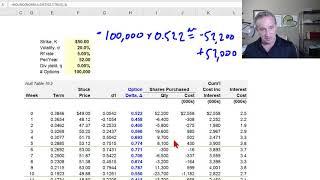

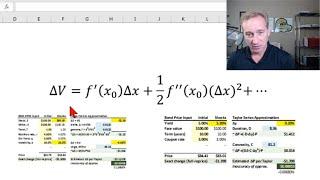

Delta-gamma value at risk (VaR) with the Taylor Series Approximation (FRM T4-4)

Bionic Turtle

5K

17,831

6 лет назад

Сейчас ищут

Bionicturtle

Galaxy S10

Molly Keyser

Badooya

Daven

Silhouette Portrait Software

Как Приготовить Вкусный Омлет

Smoma Music More

Ab Y

Betty Lim

Manifest Wealth And Abundance

Advance Gadgets

Passive Income Apps News Review Guide

Start Quiz

Steven Stein

Angell Eye

Est Gee

Руниза Про Управление Проектами Crm Bpm

Danielle Dietrich

Liberty Safes Of Oregon

Hierarchical Structures

Mmd Battle

Banda Food

Wwe Raw December 9

Action Motivation

Viper Daytona

Paní Staza

Jks Florida

Айсумайсу

Desempregados

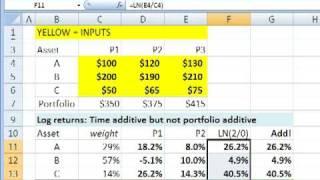

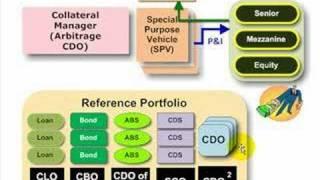

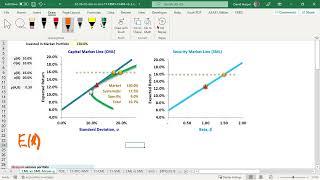

Bionicturtle. Смотреть видео: Bionic Turtle Coupon Codes Promo Codes 2020 Claim 50 Discount, Hedging Aka Neutralizing Option Delta And Gamma FRM T4 19, FRM Why We Use Log Returns In Finance, ABCs Of CDO CLO CBO CDO Of ABS.